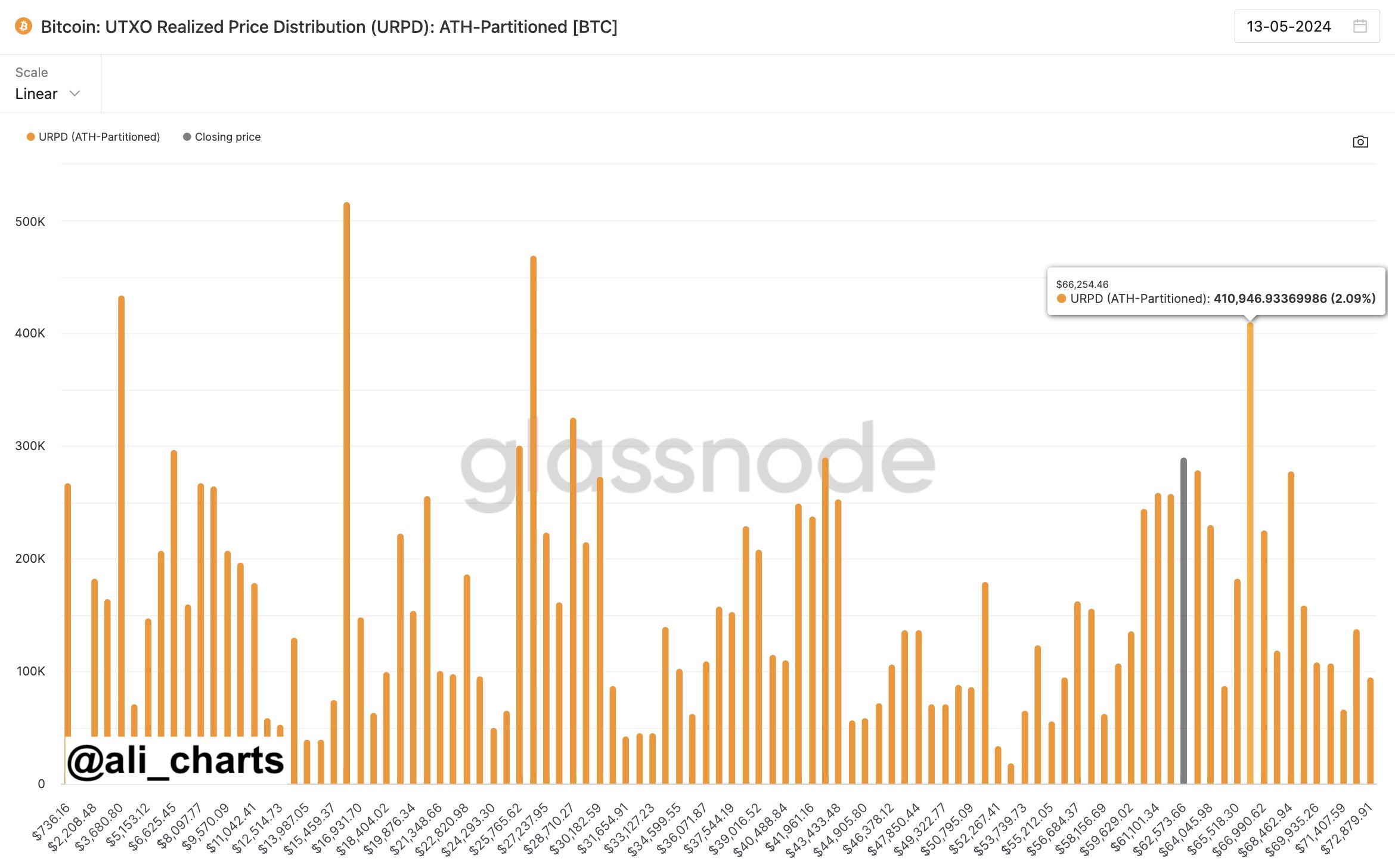

Bitcoin Will Be Set For New ATHs If It Breaks This Resistance: Analyst

An

analyst

has

explained

how

Bitcoin

could

be

positioned

for

new

all-time

highs

(ATHs)

if

it

can

break

through

this

on-chain

resistance

level.

Bitcoin

On-Chain

Data

Could

Suggest

This

Level

Holds

Major

Resistance

In

a

new

post

on

X,

analyst

Ali

discussed

Bitcoin’s

current

on-chain

resistance.

In

on-chain

analysis,

the

strength

of

support

and

resistance

levels

is

based

on

the

total

amount

of

cryptocurrency

last

acquired

at

each

level.

Below

is

a

chart

for

Glassnode’s

UTXO

Realized

Price

Distribution

(URPD)

metric,

which

shows

the

supply

distribution

across

the

various

price

levels

based

on

where

the

investors

bought

their

coins.

the

cost

basis

distribution

in

the

BTC

market

looks

like

at

the

moment

|

Source:

@ali_charts

on

X

From

the

graph,

it’s

visible

that

in

terms

of

the

levels

currently

ahead

of

the

spot

price,

the

$66,250

mark

stands

out

as

it

hosts

the

cost

basis

of

over

2%

of

all

Bitcoin

UTXOs.

Generally,

the

cost

basis

is

a

special

level

for

any

investor,

and

they

are

naturally

more

likely

to

react

when

it

is

retested,

as

it

can

lead

to

a

flip

in

their

profit-loss

situation.

The

spot

price

retesting

a

level

won’t

produce

much

reaction

if

only

a

few

investors

share

their

cost

basis

around

the

level.

Still,

if

many

holders

bought

there,

the

cryptocurrency

could

see

visible

effects

upon

a

retest.

Investors

who

are

losing

money

may

look

forward

to

such

a

retest

to

exit

out

at

their

break-even

point,

as

they

may

fear

that

the

asset

will

fall

back

down

again

in

the

future,

so

getting

away

with

their

initial

capital

would

seem

like

the

ideal

decision.

As

such,

a

retest

of

a

level

dense

with

UTXOs

from

below

can

lead

to

a

selling

reaction

in

the

market,

making

these

levels

points

of

strong

resistance

for

Bitcoin.

Since

the

$66,250

level

appears

to

be

where

the

most

coins

were

purchased

out

of

the

levels

ahead,

this

level

could

be

the

toughest

one

to

break

for

the

cryptocurrency.

On

the

brighter

side,

though,

the

levels

after

this

point

are

relatively

thin.

“Once

BTC

breaks

past

this

level,

it

will

be

positioned

for

new

all-time

highs!”

explains

the

analyst.

The

market

intelligence

platform

IntoTheBlock

has

also

discussed

about

on-chain

cost

basis

distribution

in

an

X

post

today.

As

revealed

by

the

firm,

around

10%

of

all

addresses

acquired

their

coins

between

the

current

spot

price

and

the

all-time

high

the

asset

set

back

in

March.

like

a

large

amount

of

supply

was

purchased

at

the

levels

near

the

ATH

|

Source:

IntoTheBlock

on

X

This

would

naturally

mean

that

10%

of

the

total

addresses,

equivalent

to

5.16

million,

are

in

the

red

on

the

Bitcoin

network.

BTC

Price

Bitcoin

has

continued

to

move

in

its

recent

range,

with

its

price

currently

trading

around

the

$62,800

level.

price

of

the

asset

appears

to

have

witnessed

a

jump

in

the

past

day

|

Source:

BTCUSD

on

TradingView

Featured

image

from

Erling

Løken

Andersen

on

Unsplash.com,

Glassnode.com,

IntoTheBlock.com,

chart

from

TradingView.com

Comments are closed.