Bitcoin Market Shift: Weak Hands Not Capitulating Despite Crash

On-chain

data

suggests

the

Bitcoin

short-term

holders

haven’t

been

capitulating

during

the

crash,

a

sign

that

a

shift

has

occurred

in

the

market.

Bitcoin

Short-Term

Holders

Haven’t

Been

Doing

Much

Loss-Selling

Recently

As

pointed

out

by

analyst

James

Van

Straten

in

a

post

on

X,

the

BTC

short-term

holders

haven’t

been

sending

much

BTC

at

a

loss

recently,

despite

the

plunge

the

asset’s

price

has

suffered.

The

“short-term

holders”

(STHs)

refer

to

the

Bitcoin

investors

who

bought

their

coins

within

the

past

155

days.

These

investors

make

up

one

of

the

two

main

divisions

of

the

BTC

market,

with

the

other

cohort

being

known

as

the

“long-term

holders”

(LTHs).

Statistically,

the

longer

an

investor

holds

their

coins,

the

less

likely

they

are

to

sell

at

any

point.

As

such,

the

LTHs

are

considered

the

resolute

side

of

the

market,

while

the

STHs

are

considered

the

weak

hands.

Generally,

the

STHs

easily

sell

whenever

a

change

in

the

market

happens,

like

a

crash

or

rally.

As

such,

these

investors

could

be

expected

to

have

participated

in

some

selling

during

the

latest

plummet

in

the

coin

as

well.

One

way

to

track

whether

these

investors

are

selling

or

not

is

to

track

their

exchange

deposits.

Holders

don’t

always

deposit

to

these

platforms

for

selling,

as

they

offer

other

services

as

well,

but

inflows

during

a

rally/crash

are

more

often

than

not

an

indication

of

a

selloff.

In

the

current

discussion,

the

entire

exchange

transfer

volume

for

this

cohort

isn’t

of

interest,

but

only

the

part

of

it

that’s

being

deposited

at

a

loss.

As

Straten

has

highlighted

in

the

chart

below,

a

curious

pattern

has

emerged

in

this

loss

exchange

inflow

volume

for

the

STHs.

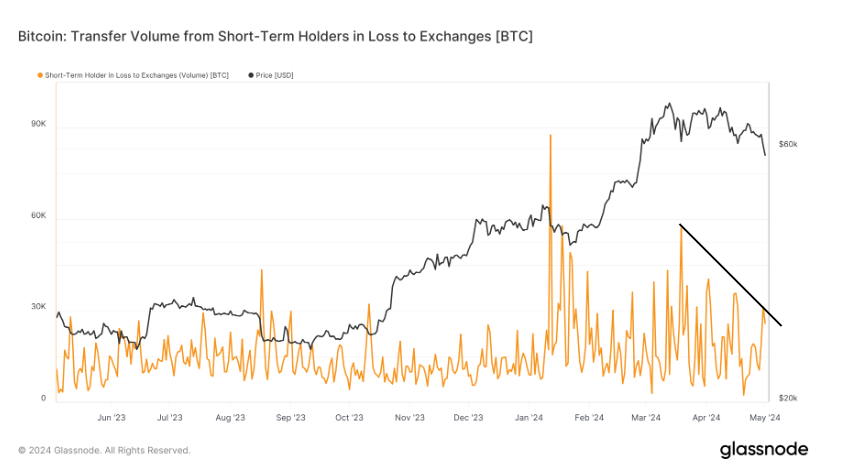

The value of the metric appears to have been on the decline in recent weeks | Source: @jvs_btc on X

As

displayed

in

the

above

graph,

the

Bitcoin

transfer

volume

from

the

STHs

in

loss

to

exchanges

registered

a

huge

spike

back

in

January,

as

the

market

downturn

following

the

approval

of

the

spot

exchange-traded

funds

(ETFs)

occurred.

In

the

price

decline

that

followed

the

top

in

May,

the

metric

also

registered

a

large

spike,

although

notably

smaller

in

scale

than

the

January

one.

It

would

appear

that

during

both

of

these

drawdowns,

the

STHs

had

shown

a

significant

capitulation

reaction.

During

the

latest

crash,

however,

the

trend

doesn’t

appear

to

have

been

the

same.

“What

is

really

interesting

is

that

in

these

past

two

days,

Bitcoin

dropped

12%,

but

STHs

sent

very

little

Bitcoin

to

exchanges

at

a

loss,”

notes

the

analyst.

This

would

suggest

that

these

weak

hands

have

gained

some

strength

recently.

“Lettuce

hands

are

becoming

slightly

less

erratic,

signs

of

a

maturing

market,”

says

Straten.

BTC

Price

Bitcoin

has

shown

some

recovery

from

the

crash

during

the

past

24

hours

as

its

price

has

now

returned

back

to

the

$60,700

level.

Looks like the price of the asset has shot up over the past day | Source: BTCUSD on TradingView

Featured

image

from

Michael

Förtsch

on

Unsplash.com,

Glassnode.com,

chart

from

TradingView.com

Comments are closed.