Bitcoin Adoption Slows Down To Multi-Year Lows, But Why?

On-chain

data

shows

the

Bitcoin

adoption

rate

has

slowed

to

the

lowest

since

July

2018.

Here’s

what

could

be

behind

this

trend.

Bitcoin

New

Addresses

Count

Has

Plunged

To

Multi-Year

Lows

According

to

data

from

the

market

intelligence

platform

IntoTheBlock,

an

interesting

trend

has

appeared

in

the

Bitcoin

New

Addresses

metric.

The

“New

Addresses”

indicator

keeps

track

of

the

total

number

of

new

addresses

created

on

the

BTC

network

every

day.

When

this

metric

has

a

high

value,

it

suggests

many

new

addresses

are

currently

popping

up

on

the

blockchain.

Such

a

trend

could

indicate

that

new

investors

are

entering

the

cryptocurrency.

However,

this

isn’t

the

only

reason

why

the

metric

would

register

an

increase,

as

old

investors

who

had

exited

earlier

could

also

contribute

to

the

indicator’s

value

when

they

return.

Holders

making

multiple

wallets

for

privacy

purposes

would

also

naturally

influence

the

metric.

In

general,

though,

all

of

these

are

happening

at

once

to

some

degree,

so

on

the

net,

some

adoption

would

occur

for

the

asset.

Thus,

a

high

number

of

new

addresses

can

be

a

bullish

sign

in

the

long

term.

On

the

other

hand,

the

indicator’s

low

value

potentially

suggests

the

cryptocurrency

isn’t

currently

attracting

fresh

investors.

Naturally,

this

would

possibly

imply

a

bearish

outcome

for

the

asset.

Now,

here

is

a

chart

that

shows

the

trend

in

the

7-day

average

New

Addresses

metric

for

Bitcoin

over

the

history

of

the

asset:

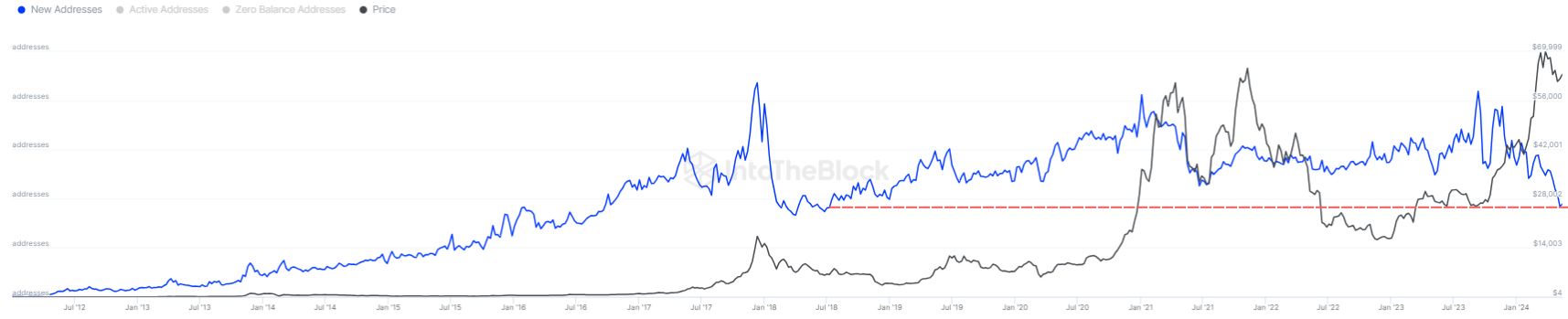

The value of the metric appears to have been going down in recent months | Source: IntoTheBlock on X

As

the

above

graph

shows,

the

7-day

average

of

Bitcoin

New

Addresses

has

declined

this

year.

This

suggests

that

fewer

and

fewer

new

hands

are

potentially

entering

the

asset.

Following

the

latest

decrease,

the

metric’s

value

has

dropped

to

just

276,000,

the

lowest

since

July

2018.

The

chart

shows

that

a

sharp

cooldown

in

new

addresses

has

generally

coincided

with

the

end

of

bullish

periods.

Thus,

going

by

this

pattern,

the

latest

rally

may

have

run

out

of

steam.

There

can,

however,

be

alternative

reasons

for

the

recent

trend

rather

than

just

a

lack

of

interest

among

investors.

A

big

event

for

Bitcoin

at

the

start

of

the

year

was

the

approval

of

spot

exchange-traded

funds

(ETFs)

by

the

US

Securities

and

Exchange

Commission

(SEC).

Spot

ETFs

are

investment

vehicles

that

provide

an

alternate

route

of

gaining

exposure

to

the

cryptocurrency

in

a

format

that’s

more

familiar

to

traditional

investors.

It’s

possible

that

the

new

users

these

days

simply

prefer

to

buy

into

spot

ETFs

instead.

Since

this

adoption

is

happening

off-chain,

it

makes

sense

why

an

on-chain

metric

wouldn’t

be

able

to

detect

it.

BTC

Price

At

the

time

of

writing,

Bitcoin

is

trading

at

around

$66,100,

up

more

than

5%

over

the

past

week.

Looks like the price of the asset has surged recently | Source: BTCUSD on TradingView

Featured

image

from

Dmytro

Demidko

on

Unsplash.com,

IntoTheBlock.com,

chart

from

TradingView.com

Comments are closed.